Introduction

Are you dreaming of becoming a retail entrepreneur? The idea of opening a shop can be both exciting and daunting, but with the right guidance, you can turn that dream into reality. In this comprehensive guide, we’ll walk you through the essential steps on how to open a retail store in the West Midlands, UK. From obtaining the necessary permissions to crafting a foolproof business plan, we’ve got you covered.

Section 1: Legal Requirements and Permissions

1.1 Business Structure: Differences, Pros, and Cons

When it comes to opening a retail store, one of the first decisions you’ll need to make is choosing the right business structure. The structure you choose will have implications for how you report income, your level of personal liability, and how you can raise capital. Below, we explore the three most common business structures—sole trader, partnership, and limited company—detailing their differences, pros, and cons.

Sole Trader

Definition: A sole trader is an individual who owns and operates a business on their own.

Pros:

- ✅ Simplicity: Easy to set up and manage.

- ✅ Full Control: You have complete control over the business decisions.

- ✅ Tax Benefits: Some tax advantages like claiming back expenses.

Cons:

- ❌ Unlimited Liability: You are personally responsible for any debts the business incurs.

- ❌ Funding: It may be more challenging to secure business loans or investors.

- ❌ Workload: The responsibility for running the business falls entirely on you.

Partnership

Definition: A partnership involves two or more people sharing the responsibilities, costs, profits, and losses of a business.

Pros:

- ✅ Shared Responsibility: Partners can share the workload and responsibilities.

- ✅ More Resources: Easier to secure funding with more than one owner.

- ✅ Profit Sharing: All profits earned from the business will be shared among the partners.

Cons:

- ❌ Joint Liability: Like sole traders, each partner is personally responsible for the debts and liabilities.

- ❌ Conflict: Potential for disagreements between partners.

- ❌ Shared Profits: You’ll need to share the profits, which could be a downside if contributions are unequal.

Limited Company

Definition: A limited company is a separate legal entity owned by shareholders and managed by directors.

Pros:

- ✅ Limited Liability: Shareholders are only responsible for the company’s debts up to the value of their shares.

- ✅ Professional Status: A limited company can give customers and clients a sense of confidence in your business.

- ✅ Tax Benefits: Potential for lower corporation tax rates and other fiscal advantages.

Cons:

- ❌ Complexity: More administrative work and legal requirements.

- ❌ Public Records: Financial records are public, which may be a concern for some business owners.

- ❌ Cost: Setting up a limited company can be more expensive due to legal and accounting fees.

Choosing the right business structure is crucial for the success of your retail store. Each has its own set of advantages and disadvantages, so consider your business needs, your personal liabilities, and your tax responsibilities carefully before making a decision.

1.2 Business Licences and Permits

To legally operate a retail store, especially one that deals with food and beverages, you’ll need to secure a few key licences and permits. Below, we outline what these are and provide a guide on how to apply for them, the waiting period for decisions, and any associated costs.

Food Premises Approval

Definition: This approval is mandatory for businesses that handle, prepare, or sell food.

How to Apply:

- Submit an application to your local council’s Environmental Health Service.

- The application will usually require details about your premises, the type of food you will handle, and your food safety management procedures.

Waiting Time:

- Generally, you should apply at least 28 days before you plan to start trading.

- The council will inspect your premises before granting approval.

Cost:

- Fees can vary depending on the local council, but you should budget around £200-£300.

Food Hygiene Certificate

Definition: This certificate ensures that you meet health and safety standards for food handling and preparation.

How to Apply:

- Complete a food hygiene training course, either online or in-person.

- After passing the course, you’ll receive your certificate.

Waiting Time:

- Online courses can be completed in a few hours, and certificates are usually issued immediately upon passing.

- In-person courses may take a day or two, with certificates issued shortly after.

Cost:

- Online courses can cost as little as £20.

- In-person courses may range from £50 to £100.

Alcohol Licence

Definition: This licence is required if you plan to sell alcoholic beverages.

How to Apply:

- Apply for a Premises Licence from your local council.

- You’ll also need a Designated Premises Supervisor (DPS) who holds a Personal Licence.

Waiting Time:

- The application process can take up to 2 months.

- Public consultation periods and potential objections can extend this timeframe.

Cost:

- Premises Licence fees vary depending on the rateable value of the property but can range from £100 to £1,905.

- A Personal Licence costs around £37, plus additional fees for training and a criminal record check.

By securing these licences and permits, you’re not only complying with the law but also gaining the trust of your customers. Always check the specific requirements in your local area, as regulations and fees can vary.

1.3 Health and Safety Regulations

Compliance with health and safety regulations is non-negotiable when opening a retail store. These regulations are designed to protect both your employees and customers. Below, we delve into the key aspects you need to consider, including fire safety assessments and employee training.

Fire Safety Assessments

Definition: A fire safety assessment is an evaluation of your premises to identify fire hazards and determine the necessary precautions.

How to Conduct:

- Identify potential fire hazards such as electrical equipment, flammable materials, and exit blockages.

- Evaluate who is at risk, including employees and customers.

- Create an emergency plan and provide fire safety equipment like extinguishers and alarms.

Frequency:

- Initial assessment should be done before opening.

- Regular assessments should be conducted annually or whenever significant changes are made to the premises.

Cost:

- Professional assessments can range from £200 to £500, depending on the size and complexity of your premises.

Employee Training

Definition: Employee training ensures that your staff are aware of health and safety protocols, including fire safety, first aid, and food hygiene.

How to Conduct:

- In-house training sessions led by qualified personnel.

- External courses and workshops.

Online Training:

- Yes, online training is possible and often more convenient.

- Websites like Udemy, Coursera, and Health and Safety England offer courses on health and safety, fire safety, and food hygiene.

Cost:

- Online courses can range from £20 to £100 per employee.

- In-person training can be more expensive, ranging from £50 to £200 per employee.

By adhering to health and safety regulations and conducting regular assessments and training, you not only comply with the law but also create a safer and more efficient work environment. Always keep records of your assessments and training sessions as they may be required for inspections or insurance claims.

1.4 Insurance: Protecting Your Retail Store

Insurance is a critical aspect of opening and operating a retail store. It serves as a safety net, providing financial protection in the event of unforeseen circumstances or accidents. Here’s why you’ll need insurance, what types are obligatory, what is “good to have,” and tips for cost-effective coverage.

Why You Need Insurance

- Financial Protection: Insurance safeguards your business against financial losses caused by incidents like theft, fire, accidents, or legal claims.

- Legal Requirements: Some types of insurance are mandatory by law, ensuring compliance with regulations and protecting the interests of your employees and customers.

- Peace of Mind: Knowing that your business is insured provides peace of mind, allowing you to focus on growth and operations without worrying about unexpected financial burdens.

Obligatory Insurance

- Public Liability Insurance:

- Obligatory: If your retail store interacts with the public, you must have this insurance. It covers claims from third parties (customers, visitors) for injury or property damage.

- Benefits: Protection against costly legal claims, medical bills, and compensation.

- Employer’s Liability Insurance:

- Obligatory: If you employ staff, even part-time or temporary, you must have this insurance. It covers claims from employees who suffer illness, injury, or damage while working.

- Benefits: Compliance with legal requirements and protection against employee claims.

“Good to Have” Insurance

- Property Insurance:

- Recommended: Covers damage or loss of your store’s physical assets due to fire, theft, vandalism, or natural disasters.

- Business Interruption Insurance:

- Recommended: Helps cover lost income if your store is temporarily unable to operate due to a covered event.

- Contents Insurance:

- Recommended: Protects the contents of your store, such as inventory and equipment, from damage or theft.

Cost-Effective Coverage Tips

- Shop Around: Get quotes from multiple insurance providers to find the best rates and coverage for your specific needs.

- Risk Assessment: Implement risk reduction measures like security systems and fire safety to lower insurance premiums.

- Bundle Policies: Consider bundling different types of insurance (e.g., public liability, property, contents) with one provider for potential discounts.

- Excess: Opt for a higher excess (the amount you pay before insurance kicks in) to lower premium costs.

- Review Annually: Regularly review your insurance coverage to ensure it aligns with your changing business needs and circumstances.

- Professional Advice: Consult with an insurance broker or advisor to get tailored recommendations.

Investing in the right insurance coverage is essential to protect your retail store from financial risks. While some insurance types are obligatory, others provide additional layers of protection and peace of mind. Carefully assess your specific risks and budget to determine the ideal insurance portfolio for your business.

Links:

- MoneySuperMarket: They offer business insurance quotes from 14 major UK insurers. You can find tailored deals for your requirements and compare them to get the most competitive price.

- NerdWallet UK: They have partnered with Simply Business to provide business insurance quotes from the UK’s leading providers. You can compare quotes from different providers and find the right cover for your needs.

- Small Business Prices: They have explored what the insurance market has to offer and provide a comparison of the top UK providers for business insurance.

Section 2: Business Planning

2.1 Market Research: Uncovering Opportunities

Market research is a cornerstone of any successful retail venture. It helps you understand your target market, assess competition, and identify potential niches and risks. Here’s how to conduct effective market research for your retail store in the UK:

Researching the Market in the UK

- Online Research:

- Utilize online resources like government websites, industry reports, and market research firms that provide data on consumer trends and market conditions in the UK.

- Surveys and Questionnaires:

- Create surveys or questionnaires to gather information from potential customers. Online survey platforms like SurveyMonkey or Google Forms can be helpful.

- Consider conducting focus groups to gain deeper insights into consumer preferences.

- Competitor Analysis:

- Study existing businesses in your industry and location to understand their customer base, pricing strategies, and marketing efforts.

- Location Analysis:

- Assess the location where you plan to open your retail store. Consider factors like foot traffic, nearby competitors, accessibility, and demographic profiles of the local population.

Understanding Competitors in the Target Area

- Competitor Mapping:

- Create a map or list of all competing retail stores in your target area. Identify their strengths, weaknesses, and unique selling points.

- Mystery Shopping:

- Visit competitor stores as a “mystery shopper” to experience their customer service, product offerings, and store layout firsthand.

- Online Presence:

- Analyze their online presence, including websites, social media, and customer reviews. Look for feedback from customers to identify areas for improvement.

- Pricing and Promotions:

- Compare the pricing strategies and promotions of competitors. Are they offering discounts, loyalty programs, or special events?

Understanding the Depth of the Market and Risks

- SWOT Analysis:

- Conduct a SWOT analysis (Strengths, Weaknesses, Opportunities, Threats) to evaluate your business’s internal strengths and weaknesses and external opportunities and threats.

download Maximizing Your Business’s Strengths: A Powerful SWOT Analysis.pdf here

- Conduct a SWOT analysis (Strengths, Weaknesses, Opportunities, Threats) to evaluate your business’s internal strengths and weaknesses and external opportunities and threats.

- Niche Identification:

- Look for unmet needs or underserved niches within your target market. This could involve offering unique products or services that competitors don’t provide.

download From Concept to Counter: Identifying Your Food Store Niche.pdf here

- Look for unmet needs or underserved niches within your target market. This could involve offering unique products or services that competitors don’t provide.

- Risk Assessment:

- Identify potential risks, such as economic downturns, changing consumer preferences, or supply chain disruptions. Develop contingency plans to mitigate these risks.

- Market Segmentation:

- Divide your target market into segments based on demographics, psychographics, or behavior. This helps tailor your marketing efforts to specific customer groups.

- Financial Projections:

- Create financial projections based on your market research to estimate potential sales, costs, and profitability.

- Legal and Regulatory Analysis:

- Research industry-specific regulations and compliance requirements to ensure you are operating within the legal framework.

Remember that market research is an ongoing process. Continuously monitor market trends, customer feedback, and competitor activities to adapt and refine your retail strategy as needed. A well-informed approach is key to positioning your retail store for success in the UK market.

2.2 Business Plan: Your Blueprint for Success

A well-crafted business plan is an indispensable tool for any entrepreneur. It serves as a roadmap that guides your business from inception to growth and provides a clear vision for the future. Here’s why a business plan is crucial and why considering optimistic, realistic, and pessimistic scenarios is beneficial:

Importance of a Business Plan

- Clarity of Vision: A business plan forces you to define your business concept, goals, and strategies, providing clarity about your venture’s purpose and direction.

- Resource Allocation: It helps allocate resources wisely by outlining your budget, funding needs, and financial projections.

- Risk Management: Identifying potential risks and challenges upfront allows you to develop contingency plans and strategies to mitigate them.

- Attracting Investors: Investors and lenders often require a comprehensive business plan to assess the viability and potential return on investment of your venture.

- Guidance: It serves as a reference point, helping you stay on course and make informed decisions as your business evolves.

Optimistic, Realistic, and Pessimistic Scenarios

Considering multiple scenarios in your business plan is essential because it prepares you for a range of outcomes:

- Optimistic Scenario: This represents the best-case scenario, where everything goes according to plan. It helps set ambitious goals and aspirations.

- Realistic Scenario: The realistic scenario takes into account the most likely outcome, based on careful analysis and research. It provides a solid foundation for your business plan.

- Pessimistic Scenario: This scenario explores potential challenges, setbacks, or unexpected events that could negatively impact your business. It helps you develop contingency plans and assess the worst-case scenario.

Sample Business Plan Draft: Grandma’s Shop

Grandma’s Shop is a small corner shop in Birmingham, UK, specializing in homemade baked goods and nostalgic candies.

Executive Summary:

- Overview of Grandma’s Shop and its unique offerings.

- Market niche: Providing a taste of nostalgia with homemade treats.

- Business objectives: Become the go-to destination for nostalgic sweets and baked goods in the West Midlands.

Business Objectives:

- Establish a strong local presence within the first year.

- Achieve a 20% increase in sales by the end of year two.

- Expand product offerings to include specialty coffee and tea by year three.

Financial Forecast (Optimistic, Realistic, and Pessimistic):

Year 1 Sales Projection:

- Optimistic: £100,000

- Realistic: £80,000

- Pessimistic: £60,000

Year 1 Expenses Projection:

- Optimistic: £60,000

- Realistic: £70,000

- Pessimistic: £80,000

Year 1 Net Profit Projection:

- Optimistic: £40,000

- Realistic: £10,000

- Pessimistic: -£20,000

By including these scenarios in your business plan, you’re better prepared to adapt to changing circumstances and make informed decisions. The realistic scenario forms the basis for your day-to-day operations and financial planning, while the optimistic and pessimistic scenarios help you set goals and devise strategies to capitalize on opportunities and overcome challenges.

2.3 Funding: Securing Capital for Your Retail Store

Funding is a crucial aspect of starting and sustaining a retail store. Whether you’re using personal savings, seeking bank loans, or attracting investors, ensuring you have adequate capital is vital. Here are some additional insights and tips on funding your retail venture:

Leveraging Your Business Type and Business Plan

- Business Type: The nature of your business can significantly impact your funding options. Some businesses, especially those with innovative concepts or high growth potential, may attract investors more easily. Others may rely on traditional loans or personal savings.

- Detailed Business Plan: A well-documented business plan can greatly enhance your ability to secure funding. It provides a clear roadmap for your business and demonstrates your commitment and understanding of the market.

Tip: Seeking Professional Validation

Before seeking funding, it’s advisable to have an unbiased assessment of your business plan. Here’s a valuable tip:

- Professional Review: Consider having your business plan reviewed by a professional team or business advisor. They can provide constructive feedback and help you identify potential weaknesses or oversights.

Exploring Additional Funding Sources

- Bank Loans: Traditional bank loans are a common funding source. A strong business plan, a good credit score, and collateral can increase your chances of approval.

- Investors: Angel investors and venture capitalists may be interested in your retail store if you have a unique concept, growth potential, or a proven track record.

- Personal Savings: Using your own savings is a viable option, especially if you want to maintain full control of your business.

- Crowdfunding: Platforms like Kickstarter and Indiegogo can help you raise capital by presenting your idea to a broader audience.

- Government Grants: Research government grants and incentives available for small businesses in your area. These can provide valuable financial support.

Tip: Government and Local Grants

- Research Grants: Explore government and local grants that may be available to support businesses in your industry or location. These grants can help cover startup costs, research and development, or expansion.

Diversifying Funding Sources

It’s often a good strategy to diversify your funding sources. For example, you might use a combination of personal savings, a bank loan, and a small investment from friends or family. Diversification can reduce risk and give you more flexibility in managing your business’s financial needs.

Remember that securing funding can be a competitive process, so having a well-thought-out plan, seeking professional input, and exploring various options can significantly increase your chances of success.

3.1 Initial Costs: Launching Your Small Food Store

When starting a small food store, it’s crucial to account for a range of initial costs to ensure a smooth launch. However, it’s equally important to be aware of hidden costs that can catch you by surprise. Let’s delve into both aspects:

Key Initial Costs to Consider:

- Location and Rent: Your store’s physical location is a significant expense. Factor in the cost of rent or lease payments, security deposits, and any required renovations or improvements.

- Inventory: Purchase the initial inventory of food products, ingredients, and packaging materials. Ensure you have a variety of items to stock your shelves.

- Equipment and Fixtures: Invest in essential equipment like refrigerators, freezers, ovens, display shelves, cash registers, and POS systems.

- Licenses and Permits: Budget for the necessary licenses and permits, such as food premises approval, food hygiene certificates, and any alcohol licenses if applicable.

- Staffing: Consider employee salaries or wages for your initial staff, including cashiers, cooks, and cleaning personnel.

- Marketing and Promotion: Allocate funds for marketing and promotional materials, such as flyers, signage, and initial advertising campaigns.

- Utilities: Account for initial utility costs, including electricity, water, and gas, as well as any setup fees.

- Insurance: Purchase insurance coverage, including public liability insurance and employer’s liability insurance, to protect your business.

- Legal and Accounting Fees: Budget for legal fees associated with business registration and any accounting or bookkeeping services required.

- Permits for Renovations: If your store needs renovations or modifications, consider the costs of permits and construction.

Hidden Costs to Be Aware Of:

- Operating Expenses: While you’re focusing on initial costs, remember that ongoing operating expenses, such as rent, utilities, and employee salaries, will continue to accrue.

- Maintenance and Repairs: Over time, equipment and fixtures may require maintenance or repairs. Plan for these costs in your budget.

- Inventory Management: Inventory management software or systems may have setup costs, and overstocking or spoilage can affect your budget.

- Unexpected Delays: Delays in renovations, permitting, or equipment delivery can result in additional costs, such as extended rent payments.

- Marketing and Advertising: To maintain a strong presence, you’ll need to continue investing in marketing and advertising beyond the initial launch.

- Taxes and Fees: Be prepared for taxes, including income tax and business rates, which are typically ongoing expenses.

- Contingency Fund: Always include a contingency fund in your budget to cover unexpected costs or fluctuations in expenses.

- Employee Benefits: Don’t forget about benefits like health insurance and paid time off if you plan to offer these to your employees.

- Waste Management: Proper disposal of food waste and packaging materials may incur costs.

- Training: Training costs for employees, especially in food safety and customer service, should be accounted for.

Understanding these initial costs and being aware of potential hidden expenses will help you create a more accurate and comprehensive budget for launching and running your small food store. This proactive approach can contribute to a successful and sustainable business.

3.2 Operating Costs: Sustaining Your Retail Store

Operating costs are the ongoing expenses that your retail store incurs to maintain daily operations and serve your customers. It’s essential to factor these costs into your budget to ensure the smooth functioning and profitability of your business. Here, we’ll explain the key components of operating costs:

Staff Wages and Benefits

- Staff Salaries: The wages or salaries you pay to your employees, including sales associates, cashiers, and any managerial or administrative staff.

- Benefits: Expenses related to employee benefits, such as health insurance, retirement contributions, and paid time off.

Inventory Costs

- Cost of Goods Sold (COGS): The expenses associated with purchasing the products you sell in your retail store. This includes the cost of acquiring, storing, and restocking inventory.

Utilities

- Utilities: Ongoing expenses for essential services like electricity, water, gas, and internet connectivity. These costs are necessary to keep your store operational.

Rent or Lease Payments

- Rent or Lease: Monthly payments for the use of your retail space. This cost is usually a fixed monthly expense.

Marketing and Advertising

- Marketing: Budget allocated for marketing efforts to promote your store and attract customers. This can include advertising, social media marketing, and promotions.

Maintenance and Repairs

- Maintenance: Costs associated with regular maintenance and repairs to keep your store, equipment, and fixtures in good condition. Preventative maintenance can help reduce unexpected repair expenses.

Insurance

- Insurance Premiums: Ongoing payments for business insurance, including public liability, property, and any other coverage your business requires.

Taxes

- Business Taxes: Taxes levied on your business, such as income tax or local business taxes. Ensure you’re aware of your tax obligations and make provisions for them.

Depreciation

- Depreciation: The gradual decrease in the value of assets like equipment and fixtures over time. While it doesn’t involve cash outflows, it’s important to account for depreciation for accurate financial reporting.

Other Miscellaneous Expenses

- Miscellaneous Costs: Small, recurring expenses that may not fit into a specific category but are essential for daily operations. These can include office supplies, cleaning services, and license renewals.

Contingency Fund

- Contingency Fund: It’s advisable to set aside a portion of your budget as a contingency fund to cover unexpected or unforeseen expenses.

Understanding and carefully managing your operating costs is vital for maintaining profitability and ensuring the long-term success of your retail store. Regularly reviewing your expenses and seeking opportunities to reduce costs or optimize spending can help your business remain financially healthy.

3.3 Revenue Projections: Forecasting Your Retail Store’s Income

Revenue projections are essential for understanding the financial health and viability of your retail store. They provide insight into your expected income over a specific period, usually a year, and help you plan for expenses, growth, and profitability. Here’s a detailed explanation of revenue projections:

Components of Revenue Projections

- Sales Forecast: This is the core of your revenue projections. It involves estimating how much money you expect to generate from selling your products or services. Consider factors like pricing, sales volume, and market demand when making these estimates.

- Pricing Strategy: Your pricing strategy significantly influences revenue. Decide on pricing that is competitive in your market while covering your costs and allowing for profit. Consider both initial pricing and any planned price changes.

- Sales Volume: Estimate the number of units or items you expect to sell during the projection period. This can be based on historical data, market research, and your marketing efforts.

- Customer Acquisition: Consider how you plan to acquire new customers and retain existing ones. Your marketing and advertising efforts play a crucial role in driving sales.

- Seasonal Variations: If your retail store experiences seasonal fluctuations in sales (common in many businesses), account for these variations in your projections.

- Payment Terms: Consider your payment terms with customers. For instance, if you offer credit or accept payments in installments, the timing of cash inflows can vary.

Creating Realistic Projections

- Market Research: Base your projections on thorough market research. Understand your target audience, their buying habits, and your competitors’ performance.

- Historical Data: If your store has been in operation for some time, use historical sales data to inform your projections. Look for trends and patterns.

- Scenario Analysis: Consider multiple scenarios, including optimistic, realistic, and pessimistic, as discussed earlier. This approach allows you to plan for a range of outcomes.

- External Factors: Be aware of external factors that can impact revenue, such as economic conditions, changes in consumer preferences, or industry trends.

- Sales Channels: If you have multiple sales channels (e.g., in-store, online, wholesale), break down revenue projections by channel to gain a more detailed picture.

Monthly or Quarterly Projections

Depending on your business’s complexity and the level of detail you need, you can create monthly or quarterly revenue projections. This allows for a more granular understanding of your cash flow and helps you identify any seasonality in your business.

Monitoring and Adjusting

Once you’ve created revenue projections, it’s crucial to regularly monitor your actual sales performance against these projections. If you’re falling short, it’s essential to assess why and adjust your strategies accordingly. Conversely, if you’re exceeding your projections, consider how to capitalize on this success.

Effective revenue projections serve as a valuable tool for financial planning and decision-making in your retail store. They enable you to allocate resources, set goals, and make informed choices that contribute to your store’s growth and sustainability.

3.4 Budgeting: Wisely Allocating Funds for Your Retail Store

Budgeting is the process of allocating your financial resources wisely to different aspects of your retail business to ensure that you operate within your means and meet your financial goals. Here’s a detailed explanation of budgeting, along with tips on using software and a sample budgeting spreadsheet:

Importance of Budgeting

- Financial Control: A budget provides a structured way to manage your finances, helping you control spending and prevent overspending.

- Goal Setting: It allows you to set financial goals and track your progress toward achieving them, such as increasing profits or reducing costs.

- Resource Allocation: Budgeting helps you allocate resources effectively, ensuring that you have enough funds for essential business operations.

- Decision Making: It aids in informed decision-making by providing insights into the financial feasibility of various initiatives or investments.

Creating a Detailed Budget

- Identify Categories: Start by identifying the main categories of your budget. Common categories for a retail store include rent, utilities, payroll, marketing, inventory, and taxes.

- Estimate Costs: Estimate the costs associated with each category. Use historical data, market research, and industry benchmarks as references for these estimates.

- Revenue Projections: Incorporate your revenue projections into the budget. This will help you ensure that your income covers your expenses.

- Fixed vs. Variable Costs: Differentiate between fixed costs (e.g., rent, insurance) that remain relatively constant and variable costs (e.g., inventory, marketing) that can fluctuate.

- Contingency: Include a contingency fund in your budget to account for unexpected expenses or changes in the business environment.

- Time Period: Decide on the budget’s time period, whether it’s monthly, quarterly, or annually. Some businesses use a combination of these.

Budgeting Software

Budgeting software can streamline the budgeting process and provide valuable insights. Some popular budgeting tools for small businesses include:

- QuickBooks: Offers budgeting and expense tracking features.

- Xero: Provides budgeting and forecasting tools.

- Zoho Books: Includes budgeting and financial analysis features.

- FreshBooks: Offers budgeting and expense tracking for small businesses.

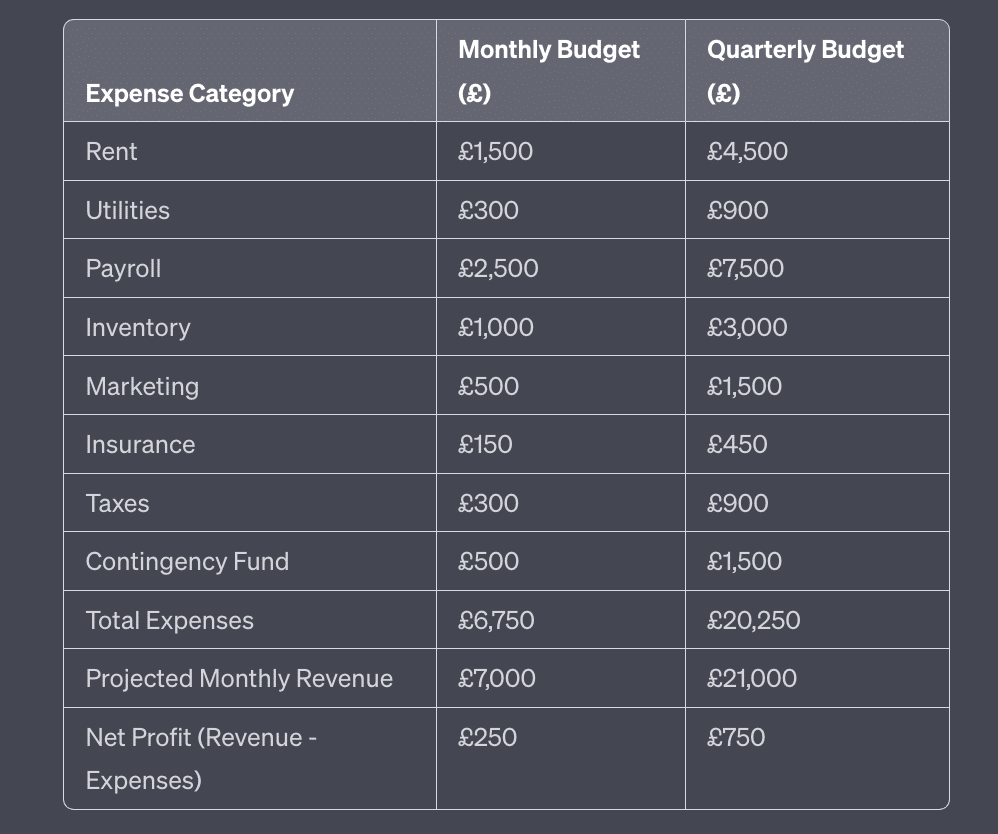

Sample Budgeting Spreadsheet

Here’s a simplified sample budgeting spreadsheet for a small retail store. This example covers some common expense categories:

How to Open a Retail Store and Master the Art of Opening a Shop in the UK – Sample budgeting spreadsheet

This sample budgeting spreadsheet outlines monthly and quarterly budgets for various expense categories. The net profit is calculated by subtracting total expenses from projected monthly revenue.

Effective budgeting is a dynamic process. Regularly compare your actual expenses and revenue against your budgeted amounts, and make adjustments as needed to stay on track and achieve your financial objectives.

Section 4: Marketing: Promoting Your Food Store

Marketing is a fundamental aspect of running a food store, and it plays a pivotal role in attracting customers, increasing sales, and building a brand. In this section, we’ll explore what marketing is, why it’s essential for your food store, and where you can learn more about it, including online courses for beginners.

What Is Marketing?

Marketing is the process of promoting and selling products or services, understanding customer needs and preferences, and building strong relationships with customers. It encompasses various strategies and tactics aimed at reaching and engaging with your target audience to drive sales and build brand loyalty.

4.1 Branding: Creating an Identity for Your Food Store

Branding, including your logo, business name, and theme, plays a significant role in defining your food store’s identity and distinguishing it from competitors. Here are key considerations for creating a strong brand:

Factors for a Good Logo:

- Memorability: A good logo should be easy to remember. Simplicity often works best, as overly complex designs can be forgettable.

- Relevance: The logo should reflect the essence of your food store. It should convey what makes your store unique, whether it’s a focus on fresh ingredients, a particular cuisine, or a commitment to quality.

- Versatility: Your logo should look great across various mediums, from signage to packaging and digital platforms. Ensure it can be resized without losing its impact.

- Uniqueness: Avoid creating a logo that resembles others in the food industry. Your logo should be distinctive to prevent confusion with competitors.

- Timelessness: While trends come and go, a timeless logo will remain relevant. Avoid designs that may quickly become outdated.

Color Theory Basics:

- Color Psychology: Different colors evoke specific emotions and associations. For example, red can convey passion and energy, while green often represents freshness or health.

- Consistency: Maintain a consistent color scheme throughout your branding materials, from your logo to your store’s interior and packaging. This reinforces brand recognition.

- Contrast: Use contrasting colors effectively to make important elements, such as your business name or logo, stand out.

- Cultural Considerations: Be mindful of cultural associations with colors. For example, white symbolizes purity in many Western cultures but can represent mourning in some Eastern cultures.

Branding vs. Competitors:

To differentiate your food store from nearby competitors, consider these strategies:

- Unique Selling Proposition (USP): Identify what sets your store apart and make it a central part of your branding. Whether it’s exclusive products, exceptional customer service, or a specific culinary focus, highlight it in your branding.

- Local and Sustainable Focus: Emphasize your commitment to local sourcing and sustainability in your branding. This resonates with consumers who prioritize ethical and eco-friendly choices.

- Customer Experience: Create a unique in-store experience that sets you apart. It could be a cozy atmosphere, personalized service, or engaging in-store events.

- Community Involvement: Engage with the local community through events, partnerships, or sponsorships. This can create a positive image and build customer loyalty.

- Online Presence: Leverage digital marketing and social media to showcase your brand and engage with customers. Consistent online branding reinforces your store’s identity.

- Pricing Strategy: Develop a pricing strategy that aligns with your brand. Whether you position your store as premium, affordable, or offering unbeatable value, ensure pricing reflects your brand image.

- Customer Feedback: Actively seek and use customer feedback to improve your branding and offerings. Listening to your customers can lead to positive changes that distinguish your store.

Remember that effective branding isn’t just about aesthetics; it’s about conveying a compelling story and promise to your customers. Your brand should reflect your food store’s values and connect with your target audience on a personal level, making them choose your store over competitors.

4.2 Digital Marketing: Expanding Your Food Store’s Online Presence

Digital marketing is a powerful tool for reaching a wider audience and promoting your food store online. Here, we’ll delve into digital marketing strategies and considerations, including automation tools, hiring marketing professionals, and budgeting for specific digital advertising avenues.

Automation Tools

- Email Marketing: Tools like MailChimp and Constant Contact enable you to automate email campaigns, segment your audience, and track performance.

- Social Media Management: Platforms like Hootsuite and Buffer allow you to schedule and manage social media posts across multiple platforms.

- SEO Tools: Services like SEMrush and Moz help you optimize your website for search engines and track keyword rankings.

- Content Marketing: Tools like HubSpot and ContentCal assist in planning and automating content creation and distribution.

- Marketing Analytics: Platforms like Google Analytics and Google Data Studio provide in-depth insights into website traffic, conversions, and user behavior.

Hiring Marketing Professionals

Consider these options when seeking professional assistance with your digital marketing efforts:

- Marketing Agencies: Marketing agencies offer a range of services and can create comprehensive digital marketing strategies tailored to your food store’s needs.

- Freelance Marketers: Freelancers can provide specialized expertise in areas like social media management, content creation, or SEO.

- Consultants: Marketing consultants offer strategic advice and can help you develop an effective digital marketing plan.

- In-House Team: If your budget allows, hiring an in-house marketing team can provide dedicated support for your digital marketing efforts.

Budget Considerations

When budgeting for digital marketing, allocate funds strategically to maximize your online presence:

- Search Engine Marketing (SEM): SEM includes paid advertising on search engines like Google. Allocate a portion of your budget to targeted keyword campaigns to appear in relevant search results.

- Local Advertisements on Google Maps: Promote your food store with location-based ads on Google Maps to reach nearby customers.

- Local Advertisements for Facebook: Utilize Facebook’s local advertising options to target users in your vicinity.

- Content Creation: Allocate resources for creating high-quality content for your website, blog, and social media channels.

- Social Media Advertising: Set aside a budget for paid social media advertising on platforms like Facebook, Instagram, or Twitter.

- Email Marketing: Invest in email marketing tools and consider allocating funds for email marketing campaigns.

- SEO Optimization: Budget for ongoing SEO efforts to improve your website’s organic search ranking.

- Analytics Tools: Include costs for marketing analytics tools to track and measure the effectiveness of your campaigns.

- Testing and Optimization: Reserve funds for A/B testing and ongoing optimization of your digital marketing strategies.

- Professional Services: If you hire marketing agencies or professionals, factor in their fees and any ongoing costs.

Remember that the effectiveness of your digital marketing efforts can vary based on your target audience, industry, and competition. Regularly assess the performance of your campaigns and adjust your budget and strategies accordingly to achieve the best results for your food store.

4.3 Traditional Marketing: Leveraging Time-Tested Strategies

While digital marketing is essential in today’s digital age, traditional marketing methods should not be underestimated, especially for a local food store. Here’s a look at the power of traditional marketing methods like flyers, posters, and local partnerships:

Flyers and Leaflets

- Distribution: Create eye-catching flyers or leaflets with your food store’s offerings and promotions. Distribute them in your local community, targeting areas with high foot traffic.

- Local Events: Attend or sponsor local events, fairs, or markets where you can distribute flyers to a receptive audience.

- In-Store Promotion: Place flyers at strategic locations within your store to inform customers about special deals or upcoming events.

Posters and Banners

- High Visibility: Design attractive posters and banners featuring your food store’s branding and products. Display them prominently both inside and outside your store.

- Local Bulletin Boards: Seek permission to place posters on community bulletin boards in places like libraries, community centers, and cafes.

- Local Partnerships: Collaborate with nearby businesses to cross-promote each other’s products and services using posters or joint advertising efforts.

Local Partnerships

- Cross-Promotion: Partner with local restaurants, cafes, or businesses to cross-promote your products. For example, a nearby coffee shop could display and sell your baked goods.

- Events and Collaborations: Organize or participate in local events, such as food tastings or charity drives, where you can showcase your offerings alongside other local businesses.

- Community Engagement: Actively engage with your local community through sponsorships, donations, or involvement in community initiatives. Positive community relationships can translate into loyal customers.

Traditional marketing methods have the advantage of tangibility and can create a strong local presence for your food store. They allow you to connect with your immediate community in a personal way, building trust and loyalty among local customers. While digital marketing extends your reach, traditional marketing helps you anchor your business within your neighborhood, fostering a sense of belonging and support.

Section 5: Suppliers

5.1 Choosing the Right Suppliers

When choosing a supplier for your business, especially for a food store, there are several factors more important than just the cheapest product price. While cost is a significant consideration, here are other crucial factors to weigh:

1. Quality and Consistency:

- Product Quality: Ensure that the supplier provides high-quality products that meet your standards. Inferior quality can negatively impact your business’s reputation and customer satisfaction.

- Consistency: A reliable supplier should consistently deliver products of the same quality over time. Fluctuations in quality can disrupt your operations.

2. Reliability and Timeliness:

- Delivery Reliability: Timely deliveries are crucial for maintaining your inventory and meeting customer demands. A supplier’s reliability in meeting delivery schedules is paramount.

- Stock Availability: Choose a supplier who can consistently provide the products you need. Frequent stockouts can harm your business.

3. Safety and Compliance:

- Food Safety: Ensure your supplier complies with food safety regulations. Products should be handled, stored, and transported in a manner that ensures safety and hygiene.

- Regulatory Compliance: Suppliers must adhere to legal and regulatory standards, including permits and certifications for food handling.

4. Communication and Responsiveness:

- Open Communication: A good supplier should maintain clear lines of communication. They should be responsive to your inquiries, concerns, and changes in orders.

- Problem Resolution: Evaluate how the supplier handles issues and problems. A reliable supplier will work collaboratively to resolve issues promptly.

5. Long-Term Relationship:

- Partnership Approach: Look for a supplier who is interested in building a long-term partnership rather than just a transactional relationship.

- Scalability: Consider whether the supplier can scale with your business. As your food store grows, your supplier should have the capacity to meet increased demand.

6. Sustainability and Ethics:

- Sustainable Practices: Consider a supplier’s environmental sustainability practices. Increasingly, consumers prefer businesses that are environmentally responsible.

- Ethical Practices: Assess the supplier’s ethical conduct, including labor practices and sourcing. Ethical considerations can influence your brand’s image.

7. Cost-Efficiency:

- Total Cost of Ownership: Instead of solely focusing on the initial product price, calculate the total cost of ownership, which includes factors like shipping, storage, and waste.

- Value for Money: Choose a supplier that offers good value for the quality of products and services provided.

8. Local Sourcing:

- Local Suppliers: Supporting local suppliers can foster a sense of community and reduce environmental impact through shorter supply chains.

- Freshness: Local sourcing can often mean fresher products, which can be a significant advantage for a food store.

When evaluating potential suppliers for your food store, consider a holistic approach that balances these factors. Ultimately, the right supplier should align with your business goals, values, and the quality expectations of your customers. While cost is important, it should be weighed against these other critical considerations to ensure a successful and sustainable supplier relationship.

5.2 Featured Supplier: Polish Bakery Mazowsze

For those seeking high-quality bakery and confectionery products for their retail store, we highly recommend considering Polish Bakery Mazowsze. This supplier is known for its outstanding reputation and offers a wide range of products that can be a valuable addition to your business. Here are some key reasons to consider them:

Advantages of Polish Bakery Mazowsze:

- Well-Known and Liked Brand: Polish Bakery Mazowsze has built a solid reputation among consumers, which can help attract customers to your retail store.

- Diverse Product Range: With over 100 bakery and confectionery products, you’ll have a wide selection to choose from to meet your customers’ preferences.

- Timely Delivery: They offer daily early morning deliveries, and in some locations, deliveries are made twice a day. This ensures that you have fresh products available for your customers.

- B2B Credit Limit: After verification, you can benefit from a B2B credit limit, simplifying the payment process for your business transactions.

- Marketing Support: Polish Bakery Mazowsze provides marketing support, which can be valuable in promoting their products within your store.

- Efficient Ordering: You can place orders conveniently through their dedicated call centre or online ordering system, making the procurement process seamless.

- Certification: The supplier holds SALSA Certification, indicating a high standard of production and compliance with food safety standards.

How to Open a B2B Account with Polish Bakery Mazowsze:

To open a B2B account with Polish Bakery Mazowsze, you have two options:

- Online: You can start the process by filling out the form on their website at https://bakerymazowsze.co.uk/partnership/.

- Contact a Sales Representative: Alternatively, you can call their sales representative at 07508076263 for assistance and guidance on setting up your B2B account.

Choosing a reliable supplier like Polish Bakery Mazowsze can significantly enhance your retail store’s offerings and customer satisfaction. Their diverse product range, strong reputation, and commitment to quality make them a valuable partner for your business.

Conclusion

In conclusion, opening a food corner shop can be a rewarding venture, but it requires careful planning and consideration. Here are the key points to remember:

- Business Planning: Develop a comprehensive business plan that outlines your goals, strategies, and financial projections. Consider optimistic, realistic, and pessimistic scenarios to be prepared for various outcomes.

- Funding: Explore your funding options, including personal savings, loans, or investors. A well-documented business plan can enhance your chances of securing financing.

- Cashflow and Budgeting: Budget carefully, considering both initial and ongoing costs. Be prepared for unexpected expenses and changes in the business landscape.

- Suppliers: Choose suppliers based on factors beyond price, such as quality, reliability, and ethical practices. A strong supplier relationship can benefit your business.

- Marketing: Invest in marketing, both traditional and digital, to reach your target audience. Continuous learning is key to mastering marketing techniques.

- Branding: Create a memorable brand identity with a strong logo, consistent color scheme, and a unique selling proposition that sets you apart from competitors.

- Local Partnerships: Collaborate with local businesses and engage with the community to build a loyal customer base.

- Customer Feedback: Listen to customer feedback and use it to improve your offerings and branding.

- Sustainability: Consider sustainable and ethical practices in your business operations, which can resonate with environmentally conscious consumers.

- Taking the First Step: Opening your food corner shop is a significant endeavor, but with careful planning and a commitment to excellence, you can take that first step towards realizing your entrepreneurial dream.

Remember that entrepreneurship is a journey, and while challenges may arise, they also present opportunities for growth and innovation. Take that first step with confidence, and with determination and the right strategies, your food corner shop can thrive and become a beloved part of your community.

Websites:

- Gov.uk – Starting a Business: https://www.gov.uk/starting-up – Official government guidance on starting and running a business in the UK, including legal requirements and resources.

- Small Business Administration (SBA): https://www.sba.gov/ – Provides a wealth of information and resources for small business owners, including startup guides and financing options.

- SCORE: https://www.score.org/ – Offers free business mentoring and a wide range of templates, tools, and resources for entrepreneurs.

- Entrepreneur: https://www.entrepreneur.com/ – Features articles, guides, and expert advice on entrepreneurship, including business trends and strategies.

- MarketingProfs: https://www.marketingprofs.com/ – Offers marketing resources, articles, and online courses to enhance your marketing knowledge.

- Google Digital Garage: https://learndigital.withgoogle.com/digitalgarage – Provides free online courses on digital marketing, data, and career development.

Books:

- “The Lean Startup” by Eric Ries: A guide to building a successful startup by focusing on efficient processes, customer feedback, and iteration.

- “Small Business for Dummies” by Eric Tyson and Jim Schell: A comprehensive resource for small business owners, covering everything from planning to financing.

- “The E-Myth Revisited” by Michael E. Gerber: Explores the common myths and challenges of entrepreneurship and offers practical solutions.

- “Contagious: How to Build Word of Mouth in the Digital Age” by Jonah Berger: Examines the psychology behind why things go viral and how to create content that spreads.

- “Influence: The Psychology of Persuasion” by Robert B. Cialdini: A classic on the principles of influence and persuasion that can benefit marketing efforts.

Courses:

- Coursera: Offers a range of courses related to business and entrepreneurship. Look for courses like “Entrepreneurship Specialization” and “Digital Marketing Specialization.”

- Udemy: Provides a variety of online courses, including “Start & Run a Local Viral Email Marketing Home Business,” and “Entrepreneurship: From Business Idea to Business Model.”

- edX: Offers courses from top universities and institutions, including “Entrepreneurship MicroMasters Program” and “Marketing in a Digital World.”

- HubSpot Academy: Provides free courses on inbound marketing, content marketing, and social media strategy.

- LinkedIn Learning: Offers courses on business, marketing, and entrepreneurship. Look for topics like “Small Business Marketing” and “Business Planning.”

These resources can serve as valuable references and learning opportunities as you navigate the world of entrepreneurship and food retail. Remember that continuous learning and staying updated on industry trends are key to the success of your food corner shop.

0 Comments